Validate

To validate an HS code, you only need to provide an HS code. If you want to validate a country-specific code, you'll also need to provide a ship-to country. If you want us to validate the code and then classify the request in case of an invalid HS code response, provide a name along with the HS code. This will ensure that we have item details to use as a basis for classification if the result is invalid.

When you choose to validate your provided HS code, Classify will verify its validity against the current tariff schedule of the specified ship-to country in the classification request. For example, if the request is for TW (Taiwan), we will check the 2022 tariff schedule for Taiwan. If the Taiwan HS code provided in the classification request is a nonexistent code or is from the 2017 version and has since been modified in the 2022 version, it will be marked as invalid.

If you don't provide a ship-to country when validating a universal 6-digit code, it will validate against the latest WCO tariff nomenclature schedule, currently the 2022 version, which updates every five years. If you provide more than 6-digits and you provide an 8+ country-specific HS code in the request, we'll ignore all digits beyond the universal 6.

If the provided HS code is not found in any WCO version, Classify will ignore it, mark it as invalid, and Classify the item based solely on the product details provided in your request.

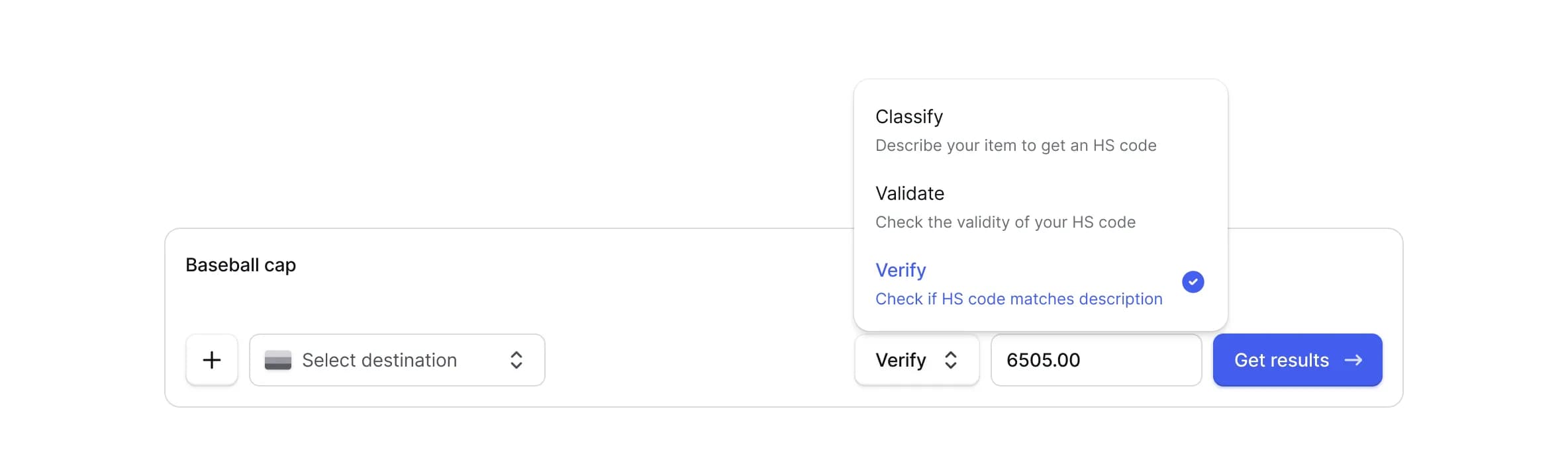

Validate existing HS code

To validate your existing HS code against the WCO tariff schedule in Dashboard or via API, follow the steps and mutation below.

- Click on Products -> Classify.

- Next to Get results, click the Classify dropdown, and select Validate.

- Optional—Describe your item.

- Click Get results.

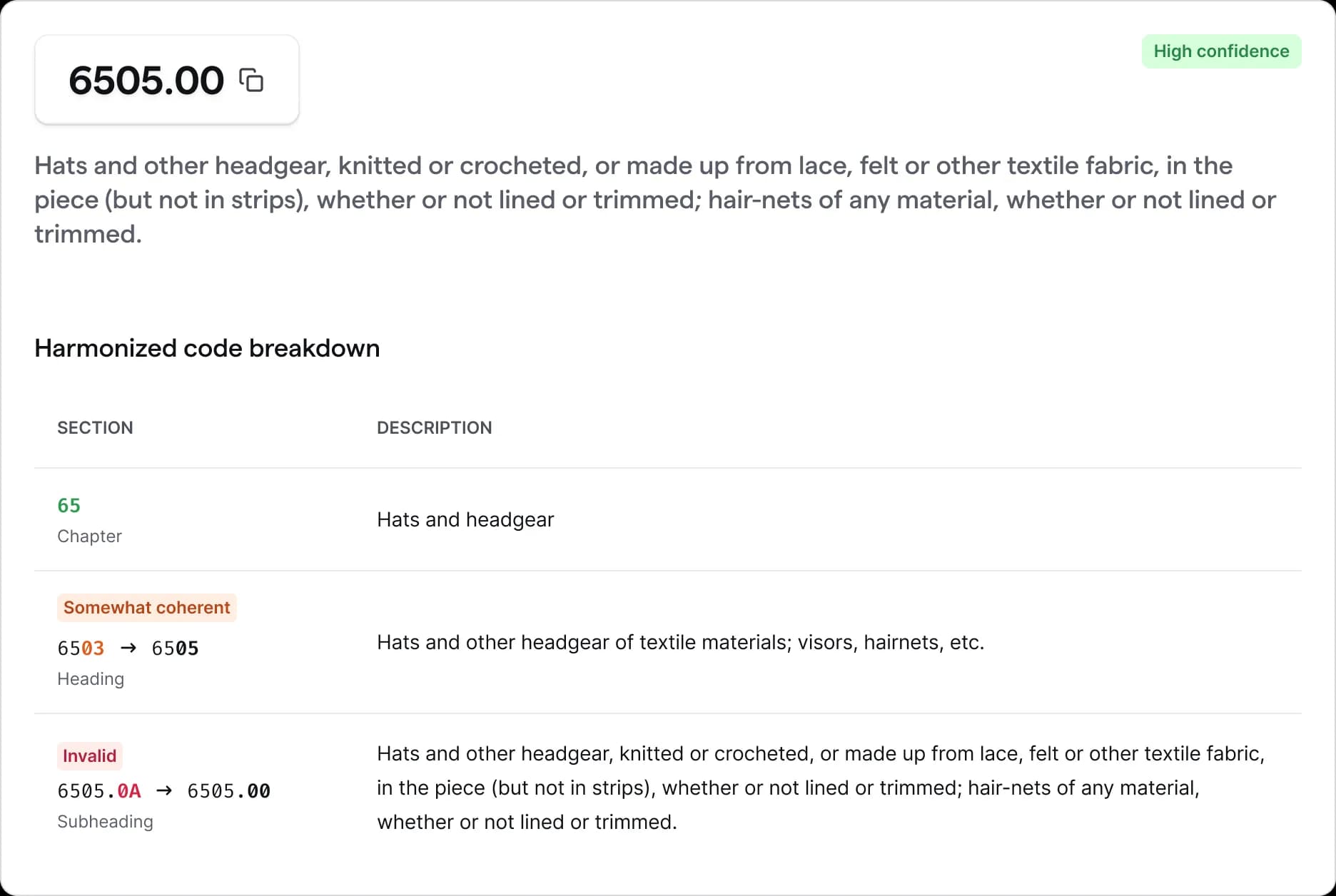

Check coherency

When checking the coherency the coherency of a provided HS code, Classify goes beyond the validation process described above and also assesses whether the code provided matches the description of the item. This ensures that the HS code provided reasonably matches the characteristics of the item, resulting in an accurate HS code and seamless customs clearance.

Similar to the validation logic, when check coherency is requested and the HS code is invalid, the provided code is ignored, and the classification is based on the product details. If the HS code is valid, Classify proceeds to check the coherency and determine whether the provided HS code was coherent, somewhat coherent, or not coherent.

If Classify deems the provided HS code “coherent”, it will return the provided HS code as Classify’s response. If Classify determines the provided HS code “somewhat coherent” or “not coherent”, Classify ignores the provided HS code and classifies from scratch. In either case, Classify will return the coherency status.

Note: Classify does not perform coherency checks on tariff level digits (beyond the subheading); instead, it validates the tariff codes and markes them as

validorinvalid.

Check HS code and description coherency

To check the coherency of your existing HS code and description in Dashboard or via API, follow the steps and mutation below.

- Click on Products -> Classify.

- Next to Get results, click the Classify dropdown, and select Check coherency.

- Optional—Describe your item.

- Click Get results.

Mapping HS codes

You can use a provided HS code to map an existing partial (2 or 4 digit) or full (universal or country-specific) HS code to a specific country following the same principles explained above.

By choosing to validate, if the HS code is valid, Classify will use it to map to your destination country. For example, if you have HS code 4901.99.9032 for a book to Australia but want to map it to Japan, Classify will validate it, truncate it to 4901.99, and map it to Japan's tariff code, 4901.99.000. If the code is invalid, the classification relies entirely on product details, not the provided HS code.

Alternatively, by choosing check coherency, Classify ensures the HS code matches the item description prior to mapping. If the HS code is invalid, the provided code is ignored. However, if the HS code is valid, it will be checked for coherency. If "coherent," Classify will use the provided HS code and map the country-specific tariff digits, mirroring the validate process outlined above. If found "somewhat coherent" or "not coherent," Classify will ignore the provided code and classify from scratch, based on the product details.

You don't need to do anything different to request the mapping functionality, provide your existing HS code, and supply a ship-to country.

Note: Please keep in mind that utilizing a provided HS code does not guarantee the absolute accuracy or correctness of the classification, as it relies on the validity and coherency of the provided code and the completeness and accuracy of the item's description details.

HS code validation

Guide your Classify results with an existing HS code.Tailored for our Classify premium users, Zonos Classify's provided HS code functionality allows you to enhance your classification requests by incorporating existing HS codes. Whether it's a partial (2 or 4 digits) or a full (universal or country-specific) HS code, you can check your classification results to ensure your existing HS codes are accurate.

When providing an HS code to Classify, you can check for validation or check your HS code's coherency. If you don't specify your preference with your provided HS code, we will default to validation.

Let's review the differences between validating and checking the coherency of a provided HS codes, helping you make informed choices that best suit your classification requirements.