Product-specific tax calculations

Zonos supports product-specific U.S. sales tax calculations for increased accuracy across different product categories. While general sales tax rates vary by location, certain products—such as clothing, food items, and books—may have different tax rates or exemptions depending on state and local laws.

Our product-specific tax system automatically applies the correct rate based on both the destination and the type of product being sold. For example, clothing might be tax-exempt in one state but taxed in another, while books may have reduced rates in certain jurisdictions.

How it works

Zonos leverages harmonized system (HS) codes—already used for international shipments—to determine the appropriate product-specific tax rate. This means no additional product categorization is required on your end. Our system automatically:

- Leverages existing HS code data to identify the U.S. product category (if not available, Zonos will Classify on the fly)

- Applies the correct state, county, and local tax rates for that specific product type

- Handles exemptions and special rates for categories like clothing, books, food items, and digital services

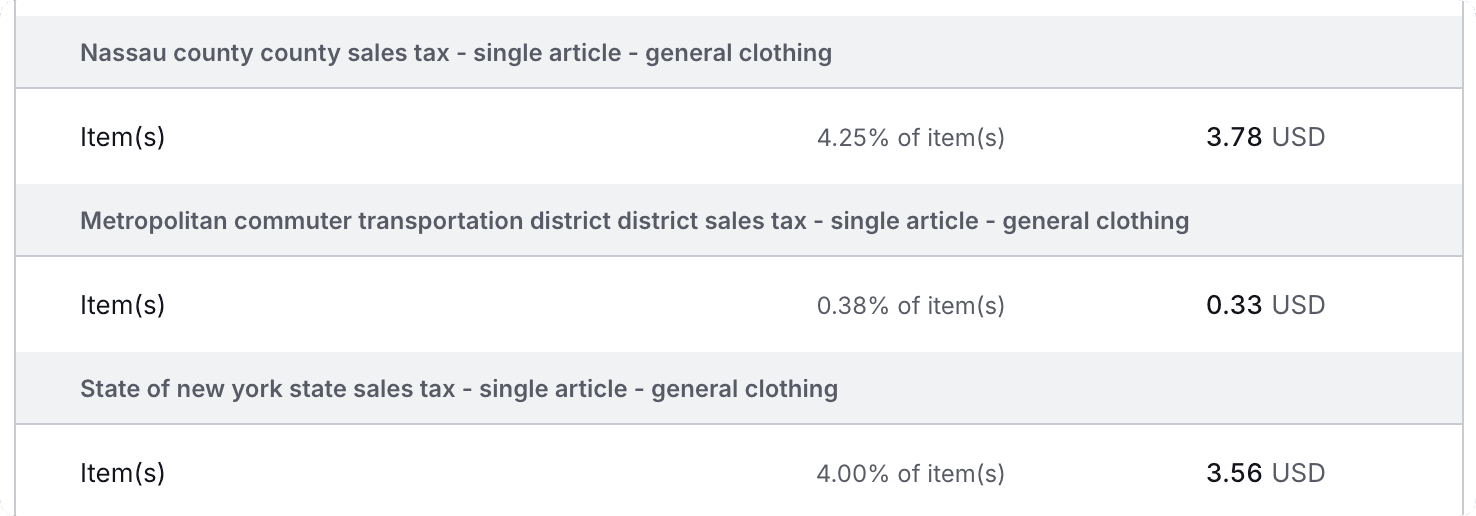

This enhanced accuracy helps ensure compliance while providing your customers with precise U.S. sales tax calculations. You can view a detailed breakdown of the applicable tax rates for each state, county, district, and city in the landed cost breakdown on the order details page.

Here's an example where state and county taxes are applied:

Zonos U.S. sales tax solution models

Zonos offers two primary models for handling U.S. sales tax compliance, depending on your integration and business needs: our co-operator model and our merchant of record model.

API or Shopify: Co-operator model

For international merchants using our API or Shopify integrations, Zonos functions as a co-operator. With this model, the merchant handles their own payment processing and Zonos doesn't appear on bank statements, but the tax compliance aspects are still fully managed by Zonos.

Co-operator requirements

For Zonos to provide co-operator services for U.S. sales tax, the following must be in place:

- Zonos Hello integration — Zonos Hello must be implemented on your website (even if running invisibly in the background without the flag icon).

- Landed cost calculation — Zonos must be calculating the landed costs.

- Signed order form — A new order form must be signed acknowledging Zonos as co-operator.

- Website reference — The merchant must make reference to Zonos on their website.

Zonos Checkout: Merchant of record (MoR) model

When Zonos acts as the merchant of record through Checkout for domestic transactions, we take on full legal responsibility for managing every aspect of sales tax compliance. With the MoR model, Zonos appears on the customer's bank statement as "Zonos-[merchant]", handles payment processing, and the tax compliance aspects are still fully managed by Zonos.

Phasing out existing U.S. state tax IDs

Zonos takes full responsibility for U.S. sales tax when acting as the merchant of record (MoR). For Zonos Checkout domestic orders, we automatically handle tax calculation, remittance, and filing. For other integrations, such as Shopify and API integrations, Zonos as MoR tax services are available as an opt-in. Depending on your integration, this transition means you may no longer need your own U.S. tax IDs for transactions processed through Zonos.

Selling on multiple channels

If Zonos is your only sales channel, you no longer need to maintain your own U.S. tax IDs. However, if you sell through other channels, you will still need to manage, remit, and file taxes for those transactions separately using your own tax IDs. Zonos assumes responsibility only for transactions processed through Zonos.

For detailed guidance on phasing out your existing tax IDs and transitioning to Zonos tax IDs, please refer to our tax phase-out documentation.

U.S. sales tax

Stay compliant with U.S. sales tax—let Zonos handle it for you with flexible integration options.

Zonos simplifies U.S. sales tax compliance with comprehensive solutions for domestic and international merchants shipping within or to the U.S. Whether using our API and Shopify integrations as a co-operator or our Checkout integration as the merchant of record (MoR), Zonos takes on responsibility for U.S. tax management, ensuring a seamless experience for you and your customers.

With all Zonos U.S. sales tax solutions, we leverage our in-house tax data to accurately calculate state, district, county, and city taxes based on the buyer's location.

Through these solutions, we:

This end-to-end approach minimizes errors, prevents penalties, and ensures your business stays compliant with all U.S. tax laws.