Ease of importing goods score: A

Ease of doing business 5/5

- With Switzerland being the innovative country it is and having Europe’s highest per capita income, it is favorable for doing business.

- Although not part of the European Union (EU), Switzerland offers the same ease of doing business as the EU and the United Kingdom.

Landed cost fairness 4/5

- Switzerland has low average duty and VAT rates, which make for a reasonable landed cost.

Flexibility of legal regulations 4/5

- Switzerland’s legal regulations are not too extensive, but businesses must follow those in place for successful clearance of goods into the country.

Availability and accessibility of shipping 4/5

- Shipping to Switzerland is accessible due to its central European location.

- Most major courier companies ship to Switzerland.

Accessibility and variety of payment methods 5/5

- There are a variety of online payment methods available and accepted in Switzerland.

Market opportunity 5/5

- Nearly 100% of the population has internet access and more than half shop online, making the Swiss ecommerce market is favorable.

Key stats for Switzerland

| ↕ | ↕ |

|---|---|

| Population | 8.753 million (2022) |

| GDP | 807.418 billion USD (2022) |

| GDP per capita | 92,434 USD (2022) |

| Internet penetration | 98% of the population use the internet (2022) |

| Ecommerce users | 72.5% of the population shop online (2022) |

| Leading product categories | Fashion, food, electronics, and digital media |

| Preferred online payment method(s) | Credit cards, PayPal, SOFORT, Klarna, and RatePay |

| Languages | German, French, Italian, and Romansh |

| Currency | Swiss franc (Confoederatio Helvetica franc)/CHF/CHF$ |

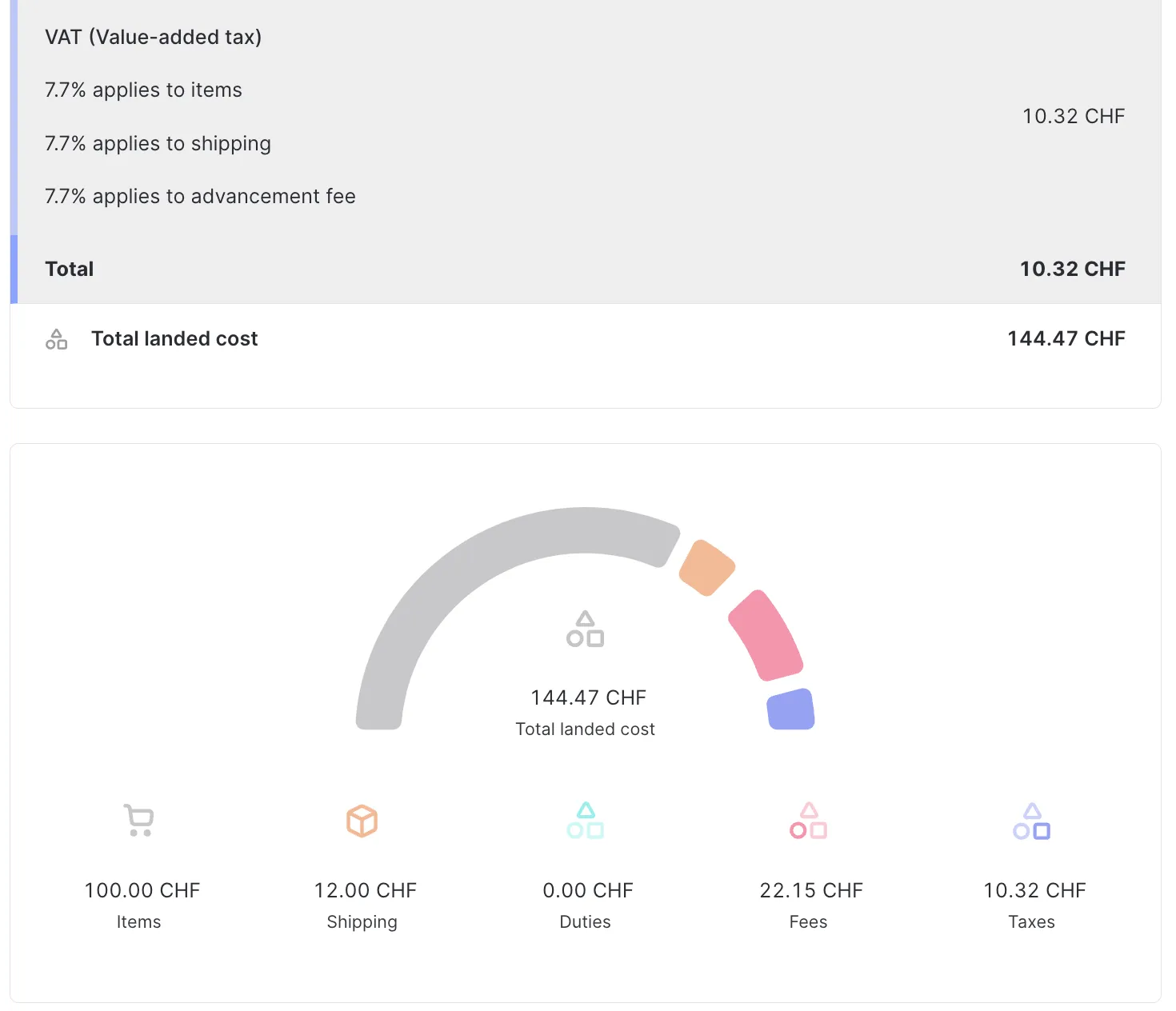

Landed cost for Switzerland

The landed cost for a cross-border transaction includes all duties, taxes, and fees associated with the purchase. This includes:

- Shipping

- Duties

- Taxes

- Fees (currency conversion, carrier, broker, customs, or government fees)

Swiss de minimis, tax, and duty

Further explanation of duty, tax, and de minimis is provided below

Duty and tax de minimis

-

Switzerland waives all duty on the order if the amount of duty owed is under 5 CHF.

-

Switzerland waives all import tax on the order if the amount of import tax due is under 5 CHF.

Based on the FOB value of the order

De minimis value

Duty and tax will be charged on imports into Switzerland where the total FOB value of the import incurs more than 5 CHF worth of either tax or duty. Any order that would be taxed less than 5 CHF will be considered a tax-free import, and any order that would have less than 5 CHF in duty charges will be considered a duty-free import.

Import tax

- Standard rate: 8.1%

- Reduced rate: 2.5%

Applied to the CIF value of the order

Value-added tax (VAT)

A 8.1% VAT is calculated on all imports into Switzerland, but only applies when the calculated tax on the import is greater than 5 CHF. Switzerland uses the CIF valuation method for calculating VAT.

- For example, if the value of the goods in a shipment is 65 CHF or more, meaning that the 8.1% VAT owed would be 5 CHF or more, then VAT will be due.

Goods such as foodstuffs, books, magazines, medications, and water qualify for the reduced VAT rate.

-

For example, if the value of the goods in a shipment is 200 CHF or more, meaning that the 2.5% VAT owed would be 5 CHF or more, then VAT will be due.

-

Switzerland Low-value Consignment Relief (LVCR)

- Switzerland's LVCR regulations impact your business if you import more than 100,000.00 CHF of low-value goods into Switzerland per year. A low-value import is anything sold cross-border with a value less than 65 CHF in Switzerland. Once you’ve crossed that threshold, you are required to register with the Swiss Federal Tax Administrationand begin charging federal and state VAT on all sales into Switzerland.

- VAT will need to be charged and collected at the time of sale once the threshold of 100,000 CHF is exceeded in a 12-month period on low-value imports into Switzerland. Imports to Switzerland from registered retailers are VAT exempt at the border since VAT was collected at the time of sale.

- For example, if your business has Swiss sales, your imports would be broken into two tax categories: those more than 65 CHF, and those less than 65 CHF. If you sold 600,000 CHF in sales a year, but only 80,000 CHF came from low-value goods (under 65 CHF), that portion of your business would still be tax-free. However, if 100,000 CHF or more came from low-value goods, you would need to register for Swiss VAT and begin charging VAT on low-value sales into Switzerland the following month.

Import duty

- Standard rate: 6.3%

Applied to the CIF value of the order

Duty rate

Duty is calculated according to the gross weight of the goods and is often less than 1 CHF per kilogram. Switzerland is unique in using commodity weight (including packaging) in the duty calculation. Duty is only applicable to shipments where the duty payable or owed on the import is greater than 5 CHF.

- For example, if the value of the goods in a shipment is 80 CHF or more, meaning that the 6.3% duty charge owed would be 5 CHF or more, then duty will be due.

Landed cost examples for Switzerland

Below are sample landed cost breakdowns for Switzerland (one above and one below the de minimis threshold) calculated using Zonos Quoter:

Landed cost for a shipment to Switzerland below the de minimis value:

Landed cost for a shipment to Switzerland above the de minimis value (no duty calculated due to weight requirements):

Trade agreements

Switzerland has at least 33 trade agreements that offer a zero or highly discounted duty rate for goods made in participating countries.

Switzerland is a member of the World Trade Organization

As a member of the World Trade Organization (WTO), Switzerland must abide by the most-favored-nation (MFN) clause, which requires a country to provide any concessions, privileges, or immunities granted to one nation in a trade agreement to all other WTO member countries. For example, if one country reduces duties by 10% for a particular WTO country, the MFN clause states that all WTO members will receive the same 10% reduction.

Customs resources

Switzerland Customs authority

Swiss Federal Office for Customs and Border Security

Customs refund in Switzerland

Note: Talk to your carrier about customs refunds.

Shipping and compliance

Top courier services:

- DHL Express

- FedEx

- UPS

- USPS

- Quickpac

- Swiss Connect

Depending on the courier, additional shipping fees may include:

- Tracking

- Insurance

- Fuel surcharge

- Remote delivery charge

- Signature fee

- Overweight or oversized fee

- Special handling fee

- Dangerous goods fee

- etc.

Documentation and paperwork

Always required:

Sometimes required:

-

Certificate Eur1

- Required for goods originating in the European Union to prove eligibility for preferential origin treatment

-

Delivery notes (freight shipments)

-

Cargo manifests (freight shipments)

-

Weight certificates (freight shipments)

-

Assessment instructions (freight shipments)

-

Proof of traceability (agricultural imports)

-

Certificate of insurance

-

Packing list

-

Certificates of origin

-

Authorizations/certificates

-

Official confirmations

-

Analysis certificates

See further explanation here.

Restricted, prohibited, and controlled items

Government agencies regulate imports.

Prohibited items:

-

All products containing the biocide dimethyl fumarate (DMF)

-

Animals and animal origin products from third countries (non-EU member states and Norway)

-

Coffee

-

Oil products

-

Plants (made in Iran)

-

Radar detectors

- Although these goods are forbidden for import and export, they may be designated for return if properly requested and declared to customs and the goods have not already been given a directive to be destroyed.

-

Slides

-

Tea

-

Textile articles

Restricted items:

- Antiques

- Artwork

- medicine

- Convention on International Trade in Endangered Species (CITES) shipments

- Certain agricultural goods

- Goods that have both military and civilian uses (i.e., "dual-use")

- Narcotics and drugs

- Fuels

- Certain knives

- Motors, turbines

- Certain articles made of steel/Iron or copper

- Radar and other navigation devices

- Vehicles (ground, air, water)

- Milk and dairy products including cheese

- Cereals and forage products

- Meat, game, seafood

- Foodstuffs

- Alcoholic beverages

- Jewelry, precious metals

- Hazardous materials

- Plants

- Tobacco products

See more detail here.

Legal regulations for businesses

Labeling and packaging requirements

Businesses selling and shipping to Switzerland need to ensure that the goods being imported are safe under Swiss standards. Additionally, as the shipper, you need to ensure you include and abide by the following to comply with Switzerland’s safety standards:

-

Meet Swiss product safety standards.

-

Follow CE (Conformitè Europëenne) marking requirements.

- Only certain product groups require CE marking.

-

Have clear instructions for the proper intended use of the product(s).

-

Include warnings about potential misuse.

What does ICS2 require retailers to do?

Everyone who ships to Europe and the UK is impacted (e.g., online retailers, manufacturers, and exporters) must ensure they have accurate information regarding the recipient and package contents before they send the shipment through the carrier or postal operator to the EU or the UK.

Is Switzerland a member of the European Union?

Though located in central Europe, Switzerland is not a member of the European Union.

If I am registered for EU VAT, do I have to register for Swiss VAT, too?

If your business meets the requirements for a Swiss VAT number, then yes. An EU VAT number is different from a Swiss VAT number.

Switzerland country guide

Learn about cross-border ecommerce, shipping, and importing.

If you are looking to grow your ecommerce business into Switzerland , you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Switzerland.

, you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Switzerland.