What it is

When a package arrives at a country’s border for importation, it goes through the customs clearance process. Clearance can also occur in transit remotely for low-value shipments. This is called express clearance and it happens when the air waybill (AWB) and commercial invoice satisfy all the import requirements. For example, the AWB and commercial invoice are complete, and accurate, and show that the shipment does not violate any import regulations or require additional inspection due to factors like restricted or prohibited goods.

The customs clearance process will be explained in detail in the next section, but here is a high-level overview of the customs clearance process:

Customs officials oversee and inspect the shipments entering and leaving the country for compliance, e.g., ensuring there is proper documentation, costs are properly assessed, applicable import licenses are supplied, there are no prohibited goods in the shipment, etc. This may involve a thorough inspection before either clearing the shipment to be released to the carrier for delivery, holding it for further inspection, or rejecting it entirely.

Customs officials are generally known to be stringent when it comes to upholding their country's trade regulations; therefore, it is important to ensure that customs has no reason to hold or reject your import so that the recipient, as the importer of record (IOR), does not have to face the repercussions of issues with the import.

Understanding the customs clearance process equips you to meet requirements effectively, ensuring your shipments pass through customs with minimal delays or difficulties.

Customs clearance steps

Here are the general steps involved in the customs clearance process.

1. Document inspection

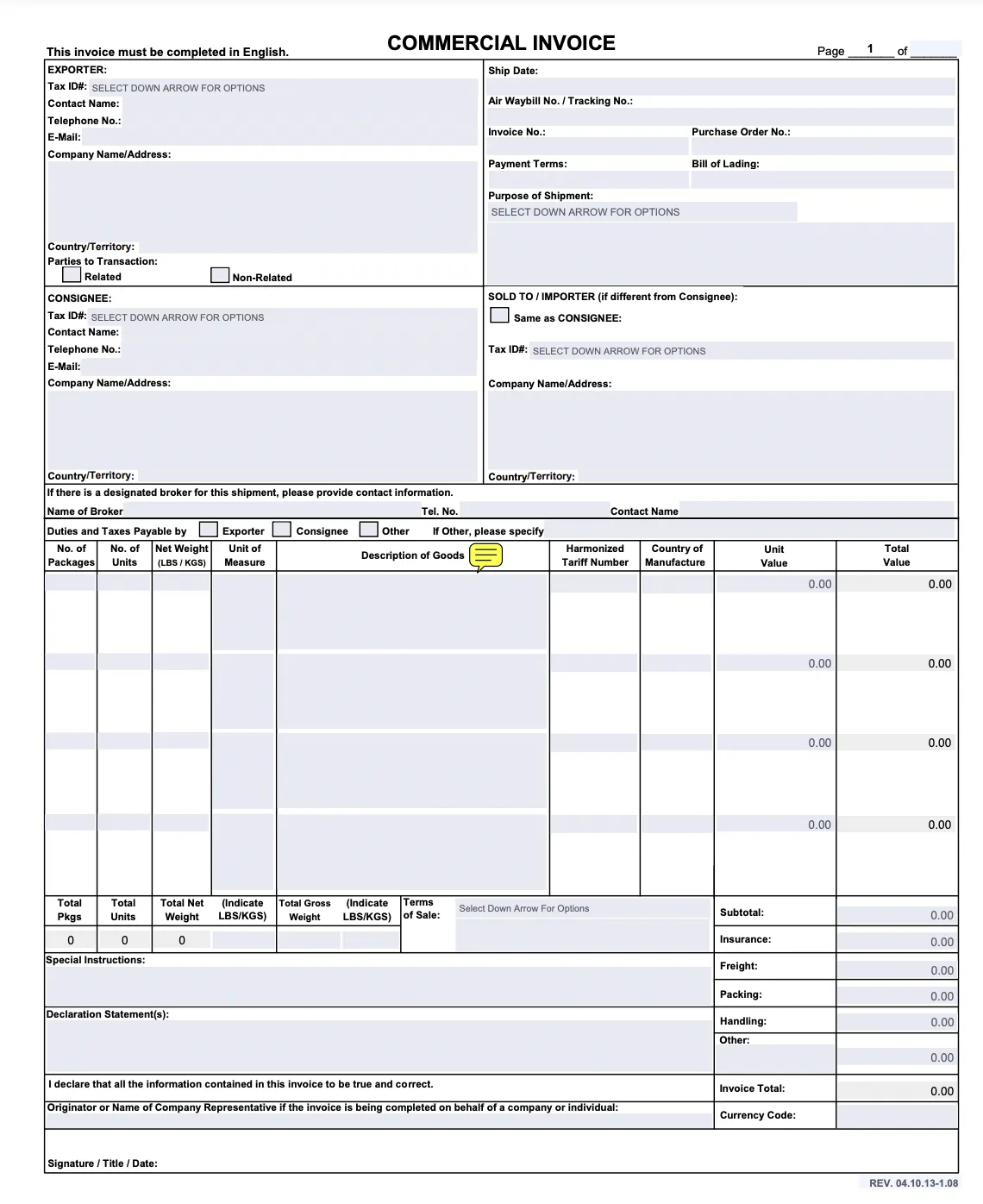

The first step in the customs clearance process is the customs officer checking the documentation associated with the commercial invoice (CI). The document inspection is most often done for a shipment electronically and remotely before the goods even arrive at the border.

The documents almost always include the CI, BOL or AWB, and packing list, but document requirements differ by country. For example, in South Korea, the minimum required documents are as follows:

-

Bill of lading (BOL) or AWB

- Filled out by sender

-

- Filled out by sender

-

Packing lists

- Filled out by sender or packer of goods

-

Maritime insurance

- Purchased by sender or buyer

-

Import declaration

- Filled out by sender or buyer

In addition to the minimum requirements, other documentation may be required in special circumstances. For example, most countries' agricultural products require special documentation or licenses.

Because the commercial invoice is always required, here’s an example of what that may look like:

Note: Missing documentation will likely result in the shipment being held or rejected until the necessary documents are provided.

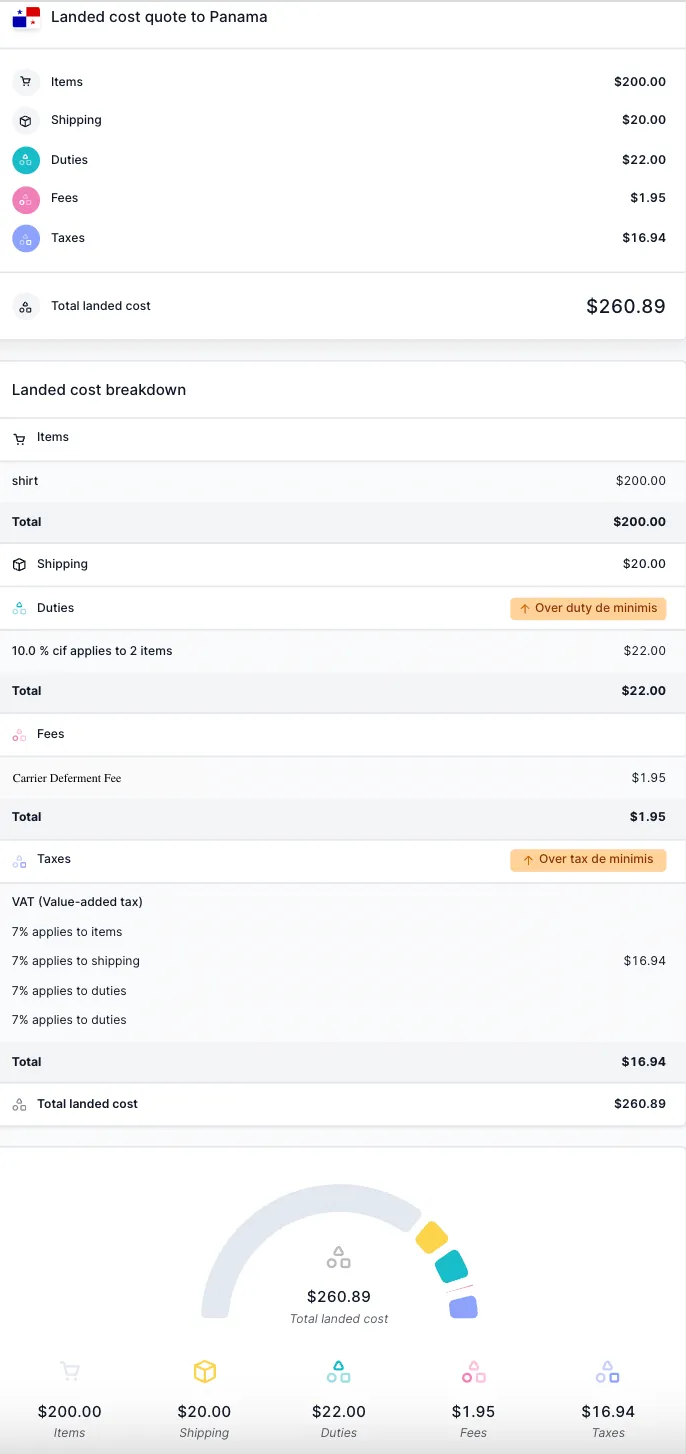

2. Duty, tax, and fee calculation

After inspecting the import documents, customs officials assess applicable duties, taxes, and fees associated with the imported goods. These fees are based on the goods' Harmonized System (HS) code classification, the country's duty calculation method, preferential origin or lack thereof, the value of the goods compared to the country's duty and tax de minimis value(s), Incoterm assessment, and more.

There are many factors that need to be taken into account when calculating import duties, taxes, and fees, i.e. the import's total landed cost. Here's an example of a landed cost breakdown for an import to Panama:

3. Incoterm assessment

Note: Delivered Duty Paid (DDP) and Delivered at Place (DAP) are International Commercial Terms (Incoterms) used in the global trade industry to define who is responsible for the payment of duties and taxes.

Once customs officials calculate the duties and taxes, the carrier and/or broker will bill the duties and taxes to the designated payer, registered VAT ID (GB VAT, IOSS, AU, NZ, etc.), or carrier account number based upon Incoterms.

- If a shipment is labeled Delivered Duty Paid (DDP), the duties and taxes have already been accounted for. This simplifies customs clearance by allowing you to charge the full landed cost at checkout and select a carrier billing option that supports DDP. The carrier usually refers to this option as bill sender or bill third party.

- If a shipment is marked Delivered at Place (DAP), this means that the duties and taxes have not yet been paid, in which case, the carrier will usually front the money to customs for the duties and taxes assessed, and then present a bill for duties, taxes, and applicable carrier fees to the customer before delivering the package. This takes longer and makes for a poor customer experience because the customer does not always know they will need to pay more to receive their package.

Note: Because the duties and taxes must be paid before the import is released from customs (if you do decide to ship DAP), it is worth double-checking to make sure a specific carrier offers this service to your destination country.

Note: For tax-registered businesses sending shipments into countries with low-value tax schemes, the shipment is typically marked DAP because the seller remits the tax to the country’s tax authority themselves. The package is not held by customs because they see the tax ID number and know the taxes will be paid even though it was sent DAP. This also avoids the carrier disbursement fees.

As mentioned above, the Incoterm can influence the fees levied on a shipment. In the landed cost quote in step 2, the “Carrier Deferment Fee” is a cost applied by some carriers to shipments sent DDP.

4. Decision about the shipment (clear, hold, or reject)

If steps one through three are completed without issues, customs will release the shipment for delivery to the final recipient.

How to avoid customs delays

To avoid customs delays:

- Follow all trade regulations of the destination country.

- Send packages as DDP.

- Register with a tax ID for countries with taxation schemes.

Is the customs clearance process the same for personal shipments (individual to individual)?

The primary difference is the potential gift allowance, which varies by country.

Is the customs clearance process the same for business-to-business (B2B) shipments?

For B2B shipments, the recipient business may reclaim VAT either during customs clearance or when filing income taxes.

Does all customs clearance occur at the importing country's border?

No, clearance for low-value shipments can occur in transit through express clearance, provided the air waybill and commercial invoice meet all import requirements.

Customs clearance for ecommerce

Learn the customs clearance process for international orders.

If you are exporting or selling goods to another country, those products must go through the customs clearance process in the importing country before reaching their final destination.

Whether it is country-specific required paperwork, duties and taxes, or product restrictions, there are many factors that can cause delays or surprises during customs clearance. Therefore, familiarizing yourself with the customs clearance process may help importation go more smoothly than it otherwise would.