Ease of importing goods score: B

Ease of doing business 3/5

- Japan has trade barriers that can delay the importation of foreign products.

- Japan’s aging population results in a declining labor force, which creates an atmosphere that welcomes nearly all imported goods.

Landed cost fairness 3/5

- Japan’s import tax rates are low, which is favorable for landed cost.

- Japan’s de minimis allows for tax-free, low-value ecommerce orders.

- Japan’s de minimis is relatively low, and disadvantageous for landed cost.

Flexibility of legal regulations 4/5

- Japan’s government makes sure that measures are taken to ensure the fulfillment of legal requirements to maintain control of foreign exchanges.

- Japan’s legal import regulations are standard and not extensive.

- Correct packing, documentation, marking, and labeling are imperative for smooth customs clearance in Japan.

Availability and accessibility of shipping 5/5

- Japan has many carrier options and services because of the high-traffic Asian trade route that runs from Japan to China and vice versa.

Accessibility and variety of payment methods 5/5

- Japan accepts a variety of popular payment options; the most popular methods are credit or debit cards.

Market opportunity 5/5

- Japan’s extensive population and high percentage of internet users gives sellers the potential for high ecommerce success.

- Japan’s consumers are sophisticated and want high-quality, trend-setting, innovative goods and services.

- Japan’s declining labor force creates a high demand for nearly all products.

Key stats for Japan

| ↕ | ↕ |

|---|---|

| Population | 123.95 million (2022) |

| GDP | 4.3 trillion USD (2022) |

| GDP per capita | 49,000 USD (2022) |

| Internet penetration | 94% of the population use the internet (2021) |

| Ecommerce users | 81% of the population shop online (2022) |

| Leading product categories | Food, personal care, fashion, beauty, toys, electronics, and media |

| Preferred online payment method(s) | Credit card, debit card, cash on delivery, and ewallets |

| Languages | Japanese |

| Currency | Yen/JPY/JP¥/¥ |

Landed cost for Japan

The landed cost for a cross-border transaction includes all duties, taxes, and fees associated with the purchase. This includes:

- Product price

- Shipping

- Duties

- Taxes

- Fees (currency conversion, carrier, broker, customs, or government fees)

Japanese duty, tax, and de minimis

Further explanation of de minimis, tax, and duty provided below

Duty and tax de minimis

- Duty and tax de minimis: 10,000 JPY

Based on the FOB value of the order

De minimis value

Duty and tax will be charged only on imports into Japan where the total FOB value of the import exceeds Japan’s minimum value threshold (de minimis), which is 10,000 JPY. Anything under the tax de minimis value will be considered a tax-free import, and anything under the duty de minimis value will be considered a duty-free import.

Import tax

- Standard rate: 10%

- Reduced rate: 8%

Applied to the CIF value of the order

Consumption tax/Value-added tax (VAT)

The consumption tax was implemented in Japan in 1989 with a standard rate of 3.0%. Over the years, the tax has increased to a standard rate of 10% and a reduced rate of 8% for certain goods. The VAT is charged based on the CIF value of the order.

The standard rate is comprised of a 7.8% national consumption tax and an additional 2.2% local consumption tax, totaling a 10% tax charge on imports where the FOB value is greater than ¥10,000.

- VAT calculation: (CIF + duty amount) x .10

Import duty

- Average rate: 4.3%

Applied to the CIF value of the order

Average duty rate

The average duty rate for imports is 4.3%.

- Duty calculation: CIF x duty rate

CIF value and example

Japan has a unique way of assessing the CIF value for B2C shipments. The CIF value must be determined before duty, tax, or order totals can be accurately calculated.

B2B SHIPMENTS

For B2B shipments, the CIF value is calculated using the standard method as follows: Cart value + Insurance + Shipping cost. Below is an example of a B2B shipment. Although all cost elements are the same value as those for the B2C shipment, see how the total differs due to the difference in how the CIF value is calculated.

Example order total cost calculation:

- Cart value: 24,000 JPY

- Insurance cost: 140 JPY

- Shipping cost: 2,900 JPY

- Duty rate: 4.3%

- First, you must determine the CIF: Cart value + Insurance + Shipping cost = CIF.

- 24,000 JPY + 140 JPY + 2,900 JPY = 27,040 JPY

- Second, determine the duty amount: CIF x duty rate = Duty amount.

- 27,040 JPY x 0.043 = 1,162.72 JPY

- Next, calculate VAT: (CIF + duty amount) x .10 = VAT.

- (27,040 JPY + 1,162.72 JPY) x .10 = VAT

- 28,202.72 JPY x .10 = 2,820.27 JPY

- Finally, calculate the order total: CIF + duty amount + VAT = Order total.

- 27,040 JPY + 1,162.72 JPY + 2,820.27 JPY = 31,022.99 JPY

B2C SHIPMENTS

The CIF value for B2C shipments is calculated as follows: (Cart value x .60) + Insurance + Shipping Cost. Below is an example of a B2C shipment. Although all cost elements are the same value as those for the B2B shipment, see how the total differs due to the difference in how the CIF value is calculated.

Example order total cost calculation:

- Cart value: 24,000 JPY

- Insurance cost: 140 JPY

- Shipping cost: 2,900 JPY

- Duty rate: 4.3%

- First, you must determine the CIF: (Cart value x .60) + Insurance + Shipping cost = CIF.

- (24,000 JPY x .60)+ 140 JPY + 2,900 JPY = CIF

- 14,400 JPY + 140 JPY + 2,900 JPY = 17,440 JPY

- Second, determine the duty amount: CIF x duty rate = Duty amount.

- 17,440 JPY x 0.043 = 749.92 JPY

- Next, calculate VAT: (CIF + duty amount) x .10 = VAT.

- (17,440 JPY + 749.92 JPY) x .10 = VAT

- 18,189.92 JPY x .10 = 1,818.99 JPY

- Finally, calculate the order total :CIF + duty amount + VAT = Order total.

- 17,440 JPY + 749.92 JPY + 1,818.99 JPY = 20,008.91 JPY

Landed cost examples

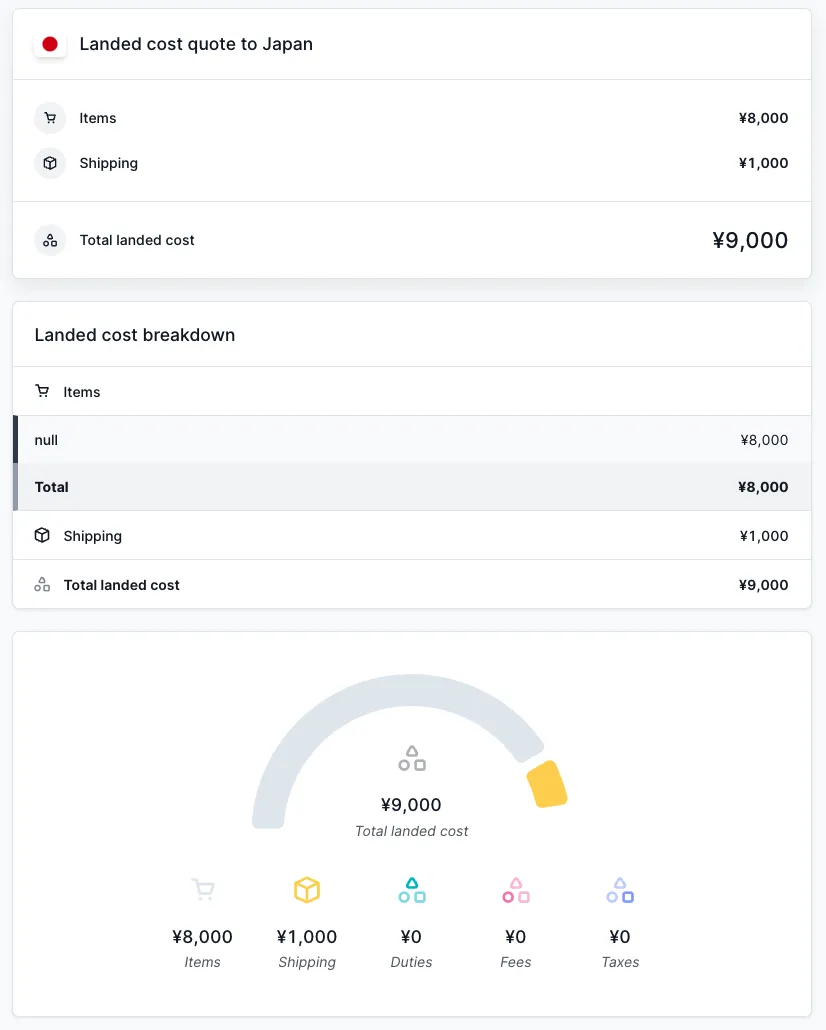

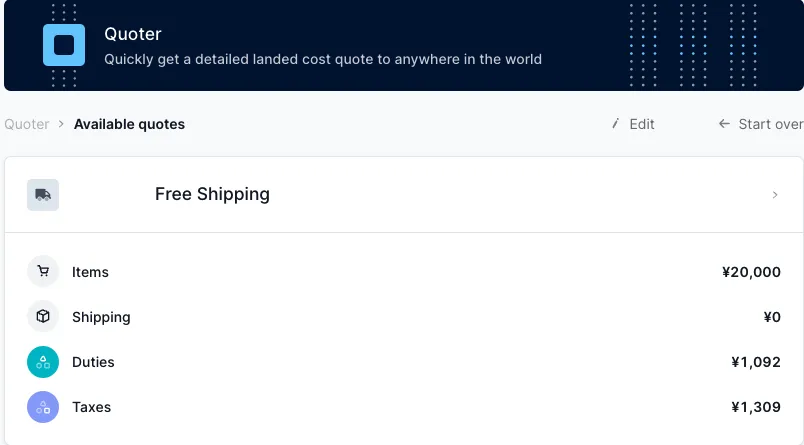

Below are sample landed cost breakdowns for Japan calculated using Zonos Quoter:

Landed cost for a shipment to Japan below the de minimis value:

Landed cost for a shipment to Japan above the de minimis value:

Trade agreements

Japan has at least 21 trade agreements that offer a zero or highly discounted duty rate for goods made in participating countries.

Japan is a member of the World Trade Organization

As a member of the World Trade Organization (WTO), Japan must abide by the most-favored-nation (MFN) clause, which requires a country to provide any concessions, privileges, or immunities granted to one nation in a trade agreement to all other WTO member countries. For example, if one country reduces duties by 10% for a particular WTO country, the MFN clause states that all WTO members will receive the same 10% reduction.

Customs resources

Japan’s Customs authority

Customs refund in Japan

Note: Talk to your carrier about customs refunds.

Shipping and compliance

Top courier services:

- DHL Express

- FedEx

- UPS

- USPS

- Yamato Transport

- Sagawa Express

Depending on the courier, additional shipping fees may include:

- Tracking

- Insurance

- Fuel surcharge

- Remote delivery charge

- Signature fee

- Overweight or oversized fee

- Special handling fee

- Dangerous goods fee

- etc.

Documentation and paperwork

Always required:

- Bill of lading or air waybill

- Commercial invoice

- The certificate of origin (where a WTO rate is applicable)

- Generalized system of preferences, certificates of origin (where a preferential rate is applicable)

- Packing lists, freight accounts, insurance certificates, etc. (where deemed necessary)

- Licenses, certificates, etc. required by laws and regulations other than the Customs Law (when the import of certain goods is restricted under such laws and regulations)

- Detailed statement on reductions of, or exemption from, customs duty and excise tax (when such reduction or exemption is applicable to the goods)

- Import declarations

- Customs duty payment slips (when goods are dutiable)

Sometimes required:

An import permit is needed for hazardous materials, animals, plants, and perishable items. You must declare what those goods are to customs and get an import permit after the necessary examination of the goods is complete. To import these certain items you need to submit an import declaration. After the required inspection and payment of customs duty and excise tax are fulfilled, you will receive an import permit.

Prohibited, restricted, and controlled items

Government agencies regulate imports.

Prohibited items:

- Narcotics and related utensils

- Firearms, firearm parts, and ammunition

- Explosives and gunpowder

- Precursor materials for chemical weapons

- Germs that are likely to be used for bioterrorism

- Counterfeit goods

- Imitation coins or currency

- Obscene materials or goods that violate intellectual property rights

Restricted items:

- Items related to health, such as medical products

- Pharmaceuticals

- Agricultural products and chemicals

- Meat products

- Endangered species and products such as ivory, animal parts, and fur

Legal regulations for businesses

Qualifications of an originating good

There are many qualifications that a product needs to fulfill in order to be an originating good. These qualifications are important to be mindful of to ensure that goods are not wrongly provided or deprived of preferential treatment.

Tips for exporting from Japan

There are rules and procedures that Japanese exporters need to be aware of prior to exportation.

What are the most popular ecommerce sites in Japan?

The most popular ecommerce site in Japan is Rakuten Ichiba, which is considered an online shopping mall. Retailers on Rakuten Ichiba sell nearly every product imaginable; over 40% of ecommerce purchases in Japan come from Rakuten Ichiba. The second most popular ecommerce site in Japan is Amazon, and the third is Yahoo Shopping.

What differentiates Japan’s ecommerce market from other progressive ecommerce markets?

Peer-to-peer (P2P) or customer-to-customer (C2C) platforms are very popular in Japan’s ecommerce market. Platforms such as Yahoo! Auctions Japan, Mercari, Rakuma, DMM, Zozo Town, Wowma, and Qoo10 Japan are widely used for online shopping in Japan.

Japan country guide

Learn about cross-border ecommerce, shipping, and importing.

If you are looking to grow your ecommerce business into Japan , you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Japan.

, you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Japan.