Ease of importing goods score: B

Ease of doing business 4/5

- The Philippines does not have foreign business registration requirements for import and is part of at least ten international trade agreements, which makes doing business a relatively smooth process.

Landed cost fairness 4/5

- The average duty rate for imports is low, which is favorable for landed cost.

- The VAT rate for imports into the Philippines is reasonable, which can help keep the landed cost down.

- The low duty rate and reasonable VAT rate balance each other out for an overall fair landed cost.

Flexibility of legal regulations 3/5

- The Philippines has few strict legal regulations, which makes the import process relatively easy.

Availability and accessibility of shipping 5/5

- Many major couriers offer shipping to the Philippines, making it very accessible for international commerce.

Market opportunity 4/5

- With more than half of the population being internet users and online shoppers, the market opportunity is positive.

Key stats for the Philippines

| ↕ | ↕ |

|---|---|

| Population | 115 million (2022) |

| GDP | 394 billion USD (2022) |

| GDP per capita | 3,623 USD (2022) |

| Internet penetration | 68% of the population use the internet (2022) |

| Ecommerce users | 63% of the population shop online (2022) |

| Leading product categories | Consumer electronics, fashion, and personal care |

| Preferred online payment method(s) | Mobile wallets, bank transfers, credit and debit cards, and cash on delivery |

| Languages | Filipino and English |

| Currency | The Philippine peso/PHP/₱ |

Landed cost for the Philippines

The landed cost for a cross-border transaction includes all duties, taxes, and fees associated with the purchase. This includes:

- Product price

- Shipping

- Duties

- Taxes

- Fees (currency conversion, carrier, broker, customs, or government fees)

Philippine de minimis, tax, and duty

Further explanation of de minimis, tax, and duty provided below

Duty and tax de minimis

- Duty and tax de minimis: 10,000 PHP

Based on the FOB value of the order

De minimis value

Duty and tax will be charged only on imports into the Philippines where the total FOB value of the import exceeds the Philippines' minimum value threshold (de minimis), which is 10,000 PHP. Anything under the tax de minimis value will be considered a tax-free import, and anything under the duty de minimis value will be considered a duty-free import.

Import tax

- Standard rate: 12%

Applied to the CIF value of the order

Value-added tax (VAT)

An import VAT rate of 12% is applied to imports into the Philippines where the FOB value exceeds 10,000 PHP.

Excise tax

The Philippines levies an excise tax on the following product categories:

-

Alcohol products

- Distilled spirits

- Wines

- Other fermented liquor

-

Tobacco products

- Cigars and cigarettes

-

Petroleum products

-

Miscellaneous rticles

- Automobiles

- Non-essential goods

- Non-essential service

- Sweetened beverages

Import duty

- Average rate: 5.7%

Applied to the CIF value of the order

Average duty rate

Although the duty rates in the Philippines range from 0-65%, the average duty rate is 5.7%.

Landed cost examples

Below are sample landed cost breakdowns for the Philippines calculated using Zonos Quoter:

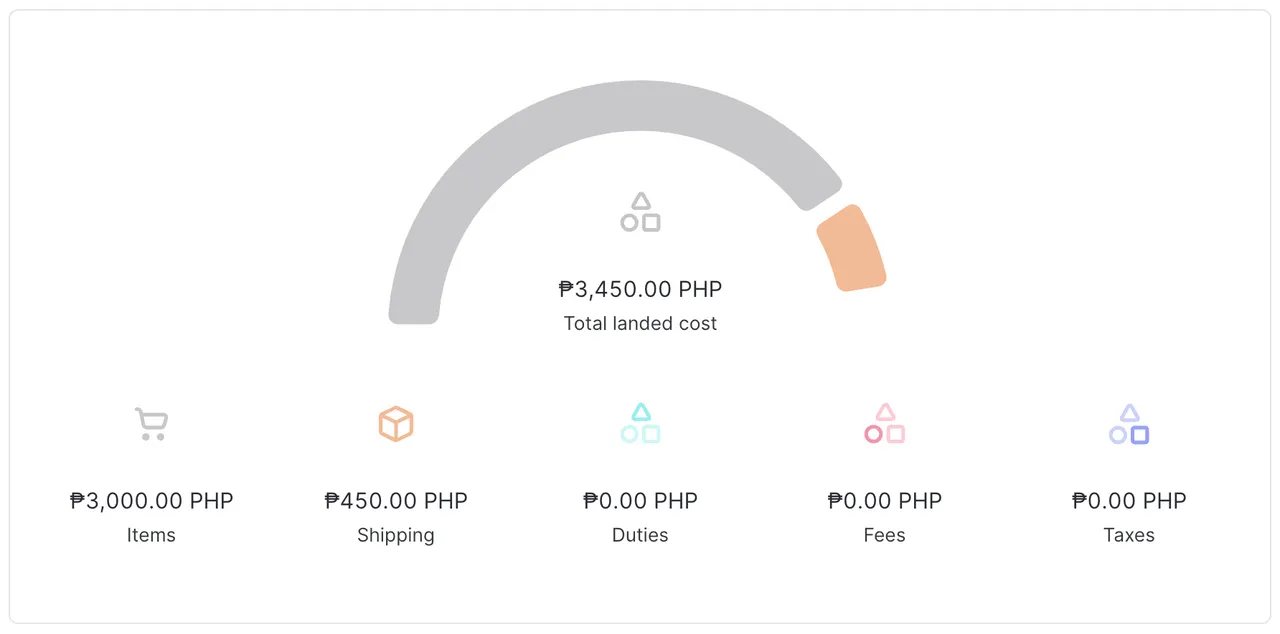

Landed cost for a shipment to the Philippines below the de minimis value:

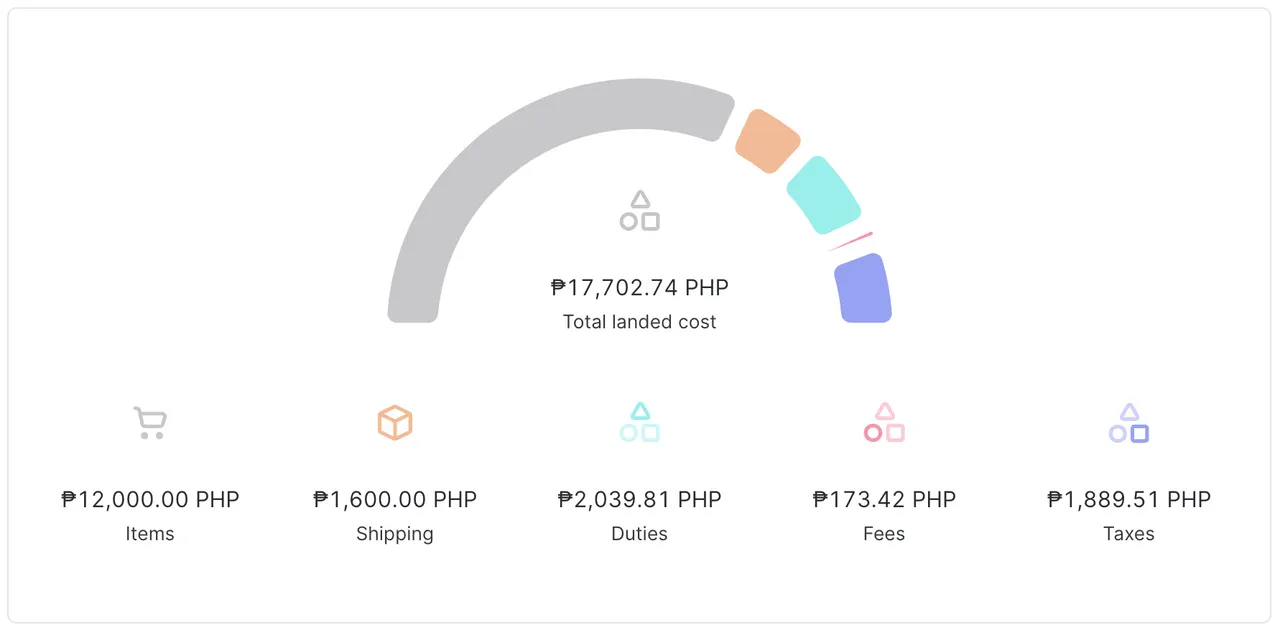

Landed cost for a shipment to the Philippines above the de minimis value:

Trade agreements

The Philippines has at least 10 trade agreements that offer a zero or highly discounted duty rate for goods made in participating countries.

The Philippines is a member of the World Trade Organization

As a member of the World Trade Organization (WTO), the Philippines must abide by the most-favored-nation (MFN) clause, which requires a country to provide any concessions, privileges, or immunities granted to one nation in a trade agreement to all other WTO member countries. For example, if one country reduces duties by 10% for a particular WTO country, the MFN clause states that all WTO members will receive the same 10% reduction.

Customs resources

The Philippines Customs authority

The Philippines Bureau of Customs

Customs refund in the Philippines

Duty drawback, refund, and abatement in the Philippines

Note: Talk to your carrier about customs refunds.

Shipping and compliance

Top courier services:

- DHL Express

- FedEx

- UPS

- USPS

- EMS Parcel Post

Depending on the courier, additional shipping fees may include the following:

- Tracking fee

- Insurance fee

- Fuel surcharge

- Remote delivery charge

- Signature fee

- Overweight or oversized fee

- Special handling fee

- Dangerous goods fee

Documentation and paperwork

Always required:

- Bill of lading or air waybill

- Packing list

- Commercial invoice

- Supplemental Declaration of valuation (SDV) form

Sometimes required:

-

Import permit

- Needed for certain regulated items

-

Customs import declaration

- Needed for certain regulated items

-

Certificate of origin

- Needed for preferential tariff treatment where applicable

Prohibited, restricted, and controlled imports into the Philippines

Government agencies regulate imports.

Prohibited items:

- Written or printed goods in any form containing any matter advocating for rebellion against the government of the Philippines

- Written or printed goods containing any threat to inflict bodily harm upon any person in the Philippines

- Goods, instruments, drugs, and substances designed for producing unlawful abortion

- Written or printed goods, or other representation of an obscene or immoral character

- Any goods manufactured in whole or in part of gold, silver, or other precious metals or alloys where the stamp or mark does not indicate the actual fineness or quality of the metals or alloy

- Any adulterated or misbranded food or goods for human consumption violation of relevant laws

- Infringing goods as defined under the Intellectual Property Code and related laws

- All other goods or parts thereof which importation is explicitly prohibited by law in the Philippines

Restricted items:

- Dynamite, gunpowder, ammunitions and other explosives, firearms and weapons of war, or parts thereof

- Any item with the intended use of gambling

- Lottery and sweepstakes tickets, except advertisements thereof, and lists of drawings therein

- Narcotics or synthetic drugs which are or may hereafter be declared habit-forming by the President of the Philippines, or any compound or preparation thereof, except when imported by the government of the Philippines for medicinal purposes

- Opium pipes or parts thereof

- Weapons of mass destruction and goods (under Republic Act No. 10697 or the Strategic Trade Management Act (STMA))

- Toxic and hazardous goods (under Republic Act No. 6969 or the “Toxic Substances and hazardous and Nuclear Wastes Control Act of 1990”)

Additional prohibited and restricted items information

Legal regulations for businesses

Import regulations for certain product categories

Certain product categories must go through specific import regulations. The categories are as follows:

- Plant products

- Meat and poultry products

- Agricultural products

- Sensitive agricultural products

- Processed food products

What is the Philippines' top ecommerce platform?

The top ecommerce platform in the Philippines is Lazada.

Philippines country guide

Learn about cross-border ecommerce, shipping, and importing.

If you are looking to grow your ecommerce business into the Philippines , you’ve come to the right place. Keep reading to learn everything you need to know

about selling goods into the Philippines.

, you’ve come to the right place. Keep reading to learn everything you need to know

about selling goods into the Philippines.