Commercial invoice by deal type

Find instructions below to fill out a commercial invoice when offering different deals.

Buy one get one free

If you offer a buy one get one free (BOGO) promotion for the same item, the commercial invoice should reflect the discount inside the item.

Below is an example of a BOGO order for a t-shirt.

Option 1

CORRECT

A BOGO should have the total quantity and a distributed unit price.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 2 | 10.00 USD |

Option 2

INCORRECT

You cannot exclude the 2nd t-shirt from the commercial invoice.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 20.00 USD |

Option 3

INCORRECT

You cannot list the 2nd t-shirt at 0.00 even if it was free on the order.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 20.00 USD |

| Men’s 100% cotton t-shirt | 1 | 0.00 USD |

If a broker or Customs sees an item listed at 0.00, they will enter an arbitrary dollar amount and charge duty and tax when applicable. If the item is not listed on the commercial invoice and Customs inspects the package, the broker will enter an arbitrary dollar amount and charge duty and tax when applicable. They may also assess fees or flag your account, which compounds future problems.

Free items

If you offer a free but different item, the commercial invoice should include the item listed at a reasonable sale price.

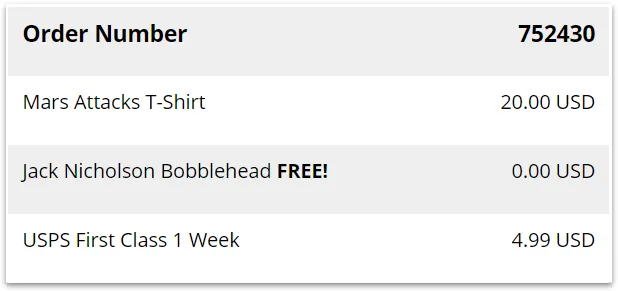

Below is an example of a free item added to an order of a bobblehead doll.

Option 1

CORRECT

The bobblehead toy needs to be listed and must have a price.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 15.00 USD |

| Bobblehead toy doll | 1 | 5.00 USD |

| Shipping | 4.99 USD |

Option 2

INCORRECT

You cannot exclude the bobblehead toy from the commercial invoice.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 20.00 USD |

| Shipping | 4.99 USD |

Option 3

INCORRECT

You cannot list the bobblehead at 0.00 even if it was free on the order.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 20.00 USD |

| Bobblehead toy doll | 1 | 0.00 USD |

| Shipping | 4.99 USD |

Samples

Include a valuation figure that is completely accurate to your knowledge; the value cannot be zero. Also, include a comment to Customs on the commercial invoice to show that the consumer was not charged for the sample, e.g., No charge for promotional item. If Customs officials at the destination country have reason to believe the valuation is not correct, they may hold a package for further investigation. It’s important to recognize that all materials have an intrinsic value, too. For example, even if you’re sending a product sample, your valuation should at a minimum represent the cost of the materials it took to produce it.

Below is an example of a free sample item (1.5mL lotion) order.

Option 1

CORRECT

The sample lotion needs to be listed and must have a price. Include a comment about not charging the customer for the free sample.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Sample 1.5mL organic lavender lotion- NO CHARGE FOR PROMOTIONAL ITEM | 1 | 3.00 USD |

| Shipping | 4.99 USD |

Option 2

INCORRECT

You cannot list the sample lotion at 0.00 even if it was free on the order.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Sample 1.5mL organic lavender lotion- NO CHARGE FOR PROMOTIONAL ITEM | 1 | 0.00 USD |

| Shipping | 4.99 USD |

Promo codes

Promo codes applied to an entire order should have the price distributed between the remaining items on the order. A commercial invoice cannot contain a negative amount or something that is not an actual item. If you do not distribute the discount between the items, the payer of the duties and taxes will pay more than what is necessary. Even worse, if not applying the promo code kicks the order over a de minimis threshold, the payer will go from no duties or taxes to paying duties and taxes. See the example below.

Option 1

CORRECT

The discount needs to be distributed between the items. In this case, each item is listed at 25% less than the retail price.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 15.00 USD |

| Men’s 100% cotton costume for dress up | 1 | 11.25 USD |

| 100% cotton headband | 1 | 3.75 USD |

| Shipping | 4.99 USD |

Option 2

INCORRECT

The payer of duty and tax will overpay if you do not distribute the discount.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 20.00 USD |

| Men’s 100% cotton costume for dress up | 1 | 15.00 USD |

| 100% cotton headband | 1 | 5.00 USD |

| Shipping | 4.99 USD |

Option 3

INCORRECT

Items on a commercial invoice should only contain actual imported items greater than 0.00.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 20.00 USD |

| Men’s 100% cotton costume for dress up | 1 | 15.00 USD |

| 100% cotton headband | 1 | 5.00 USD |

| Promo code | 1 | -10.00 USD |

| Shipping | 4.99 USD |

If the discount or promo code only applies to an individual item, then that item should list the net amount on the commercial invoice.

If you are unable to change the commercial invoice item prices, it would be best to calculate duties and taxes on the item gross amounts and exclude discounts in the landed cost calculation.

Free shipping

If you offer free shipping, you may be tempted and even feel justified in leaving the shipping amount blank or putting “0.00” as the shipping value on the commercial invoice. However, you will be rolling dice with the broker, as they may use the full retail shipping cost as the shipping value, which can be very costly.

The reality is that there is a true cost to shipping the product, but it’s baked into the cost of the products. It’s important to extract a reasonable cost for the shipping services from the cost of the products when filling out a commercial invoice. This is a more accurate representation of the true costs for the transaction and may even result in a lower landed cost in some situations.

Option 1

CORRECT

If free shipping was offered, enter a reasonable amount in shipping. 7 USD was used in this case.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 16.00 USD |

| Men’s 100% cotton costume for dress up | 1 | 12.00 USD |

| Shipping | 7.00 USD |

Option 2

INCORRECT

Do not list 0.00 in the shipping field on the commercial invoice. If this was a 1 lb. package shipped with DHL, the retail price from US to NL is 100.24 USD.

| Full description of goods | Qty | Unit value |

|---|---|---|

| Men’s 100% cotton t-shirt | 1 | 20.00 USD |

| Men’s 100% cotton costume for dress up | 1 | 15.00 USD |

| Shipping | 0.00 USD* |

*Broker decides the shipping amount and add it to the order, e.g., 100.24 USD.

In countries where duty and tax can be applied to shipping, the broker may add an arbitrary shipping amount to the commercial invoice. If the shipper was UPS, FedEx, or DHL (and the broker decides to apply the published shipping rate to the commercial invoice), the additional import duties and taxes could be ridiculously high. This is because most companies have a high discount on international shipping with international express shipping providers.

Gifts

Gifts from a retailer, shipped to a consumer

The shipping label and commercial invoice on gift shipments must have no company name listed; Customs will not honor a gift as a free shipment of zero value when it is shipped from an online merchant store or when the shipping label shows merchant or company involvement.

Gifts sent from an individual to an individual

Many countries and economies allow unsolicited gifts and personal items to enter the country duty-free, up to a certain value limit. Gifts exceeding that value limit are subject to import duties and taxes. To qualify for gift exemption, your international shipment must meet the following requirements:

- It must be sent person-to-person with no company involvement or indication of involvement on the shipping documentation, e.g., No company name listed on the airway bill.

- The shipping documentation must be marked "Unsolicited Gift" in addition to the commodity name and the detailed description, e.g., Unsolicited gift: white microfiber composite leather Wilson volleyball.

- The total value of the shipment must not exceed the values prescribed by Customs.

Commercial invoice discounts

How to apply discounts to commercial invoices.Applying promo codes, discounts, free items, free samples, BOGOs, or free shipping to a commercial invoice can be tricky when you consider the possibility that Customs may not accept it. If you offer coupons or discounts in your cart, this may also cause a reconciliation issue between your order total and commercial invoice total.

The manner in which you fill out a commercial invoice may result in unexpected charges for the payer of duties and taxes. Your ability to fill out the commercial invoice correctly also impacts how you want to calculate a total landed cost.

Partial discounts on specific items or shipping costs should be applied as expected. Example: 20% off a 10 shirt means 8 would be displayed on the commercial invoice for that shirt. It gets more difficult to know how to apply order level discounts or discounts that zero out the cost for an item or service, e.g., BOGO, Free Shipping, etc. We recommend you apply the value of these discounts exclusively to the items whenever possible. Some common examples are listed below.