Send shipments to the U.S. via Canada Post

With a Verified Account, you can send shipments to the U.S. via Canada Post without being stopped for lack of duty payment. Here's how it works:

- You ship your package through Canada Post using your connected Verified Account.

- Canada Post and Zonos ensure the package is marked as prepaid (we use a marker called a Declaration ID, tied to your tracking number).

- Zonos bills you for the duties and processing/clearance fees on each shipment as it is processed by the post.

- Zonos remits the duties to CBP on behalf of Canada Post.

How to create Canada Post labels with a Verified Account

Label creation depends on the shipping system you use.

Once you have completed your setup, there's only one step to check each time you print a label for a shipment under $800 USD going to the U.S.:

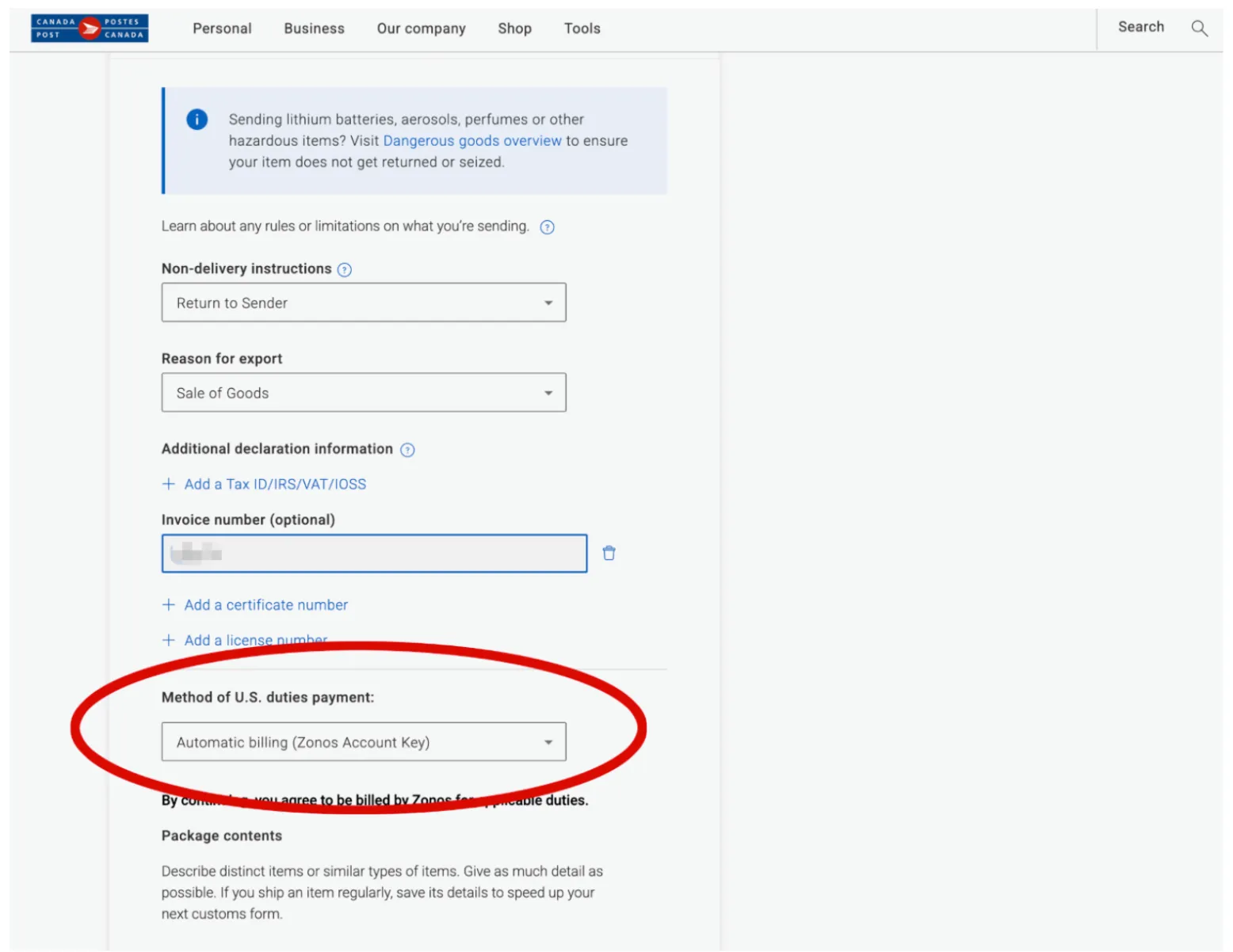

- Select Automatic billing (Zonos account key) under Method of U.S. duties payment when filling out your shipment details.

This ensures Canada Post knows duties are covered so they can issue your label. Zonos will bill you for the associated duties once we receive the shipment data from the post.

FREE Use Zonos Dashboard Lite to calculate U.S. duties on your products

Your Verified Account gives you free access to Zonos Dashboard Lite, which includes tools to help you calculate duties on your products. With these calculations, you can build the true cost of cross-border shipping into your product or shipping price—so there are no surprises for you or your customers.

Item Quoter

Item Quoter is your quick tariff calculator for individual products. Perfect for building duty costs into your product pricing before shipping with Canada Post.

How to calculate duty rates

- Go to Dashboard → Item Quoter.

- Add your item price and currency.

- Add your made-in country (where your item was manufactured).

- Select destination country.

- Enter your item description.

- Click Get result.

Review the returned duty rates for postal service. You can use this calculation to know how much to buffer your product prices or shipping prices to cover duty cost.

Best practices for accurate duty rates

- Accurate descriptions: Use “sterling silver ring with gemstone” instead of “jewelry”.

- Country of origin: Where the product was made, not your business location.

- Pricing strategy: Add calculated duties to your product pricing to ensure profitable DDP shipping.

Need just an HS code? Enter item description only. No price or country of origin required for classification-only lookups.

FREE Use Dashboard Lite for HTS code classifications

Your Verified Account gives you access to Dashboard Lite, which includes tools to classify your products with HTS codes. HTS codes are required when shipping internationally to the U.S. and tell customs what kinds of products are in the packages entering the U.S.

Item Quoter

Item Quoter is your quick tariff classification tool for individual products.

How to get an HTS code classification

- Go to Dashboard → Item Quoter.

- Enter your item description (use detailed descriptions to improve accuracy).

- Select destination country (United States).

- Click Get result.

What you can do with your Verified Account

Once you have created your Verified Account, you can: