Ease of importing goods score: C

Ease of doing business 4/5

- With a sophisticated and efficient ecommerce industry, not to mention being the second-largest economy in Latin America, Mexico is favorable for doing business.

- Mexico is a member of several trade organizations and has a very competitive market. Mexico has deep trade and investment ties with the United States (U.S.), which makes it favorable to do business there if you are located in the U.S.

- The State Department does a security assessment for every state in Mexico, and the American Chamber of Commerce in Mexico (AmCham) directs a survey of security trends that affect businesses annually.

Landed cost fairness 3/5

- The duty and VAT rates are relatively low, which is favorable for landed cost.

- Mexico’s tax de minimis is low, which is not favorable for landed cost.

- Their duty de minimis is very high, which is beneficial for imports.

Flexibility of legal regulations 3/5

- Mexico’s legal regulations require several forms of documentation and procedures. All regulations must be followed to ensure that goods are smoothly and successfully cleared into the country.

Availability and accessibility of shipping 5/5

- There are many carrier and shipping options due to Mexico’s relatively large landmass and relatively large population.

Accessibility and variety of payment methods 5/5

- Available payment methods include credit cards international cards, local debit cards, cash, online processors, e-wallets, etc.

Market opportunity 3/5

- Under half of Mexico’s population shop online. However, with the size of the Mexican market and population, there is market opportunity for nearly every product.

- Mexico has the 15th-largest economy in the world.

- Mexico has a relatively low tax de minimis, which can make shoppers more hesitant to purchase goods from across the globe because those imports will incur duties and/or taxes if the shipment exceeds the tax de minimis.

Key stats for Mexico

| Population | 130.9 million (2022) |

| GDP | 1.3 trillion USD (2022) |

| GDP per capita | 9,926 USD (2022) |

| Internet penetration | 74% of the population use the internet (2022) |

| Ecommerce users | 48% of the population shop online (2022) |

| Leading product categories | Integrated circuits, refined petroleum, vehicle parts, office machine parts, and cars |

| Preferred online payment method(s) | Debit cards, Visa, MasterCard, American Express, PayPal, cash payments, Mercado Pago app, phone payments, prepaid cards, and e-wallets |

| Languages | Spanish |

| Currency | Mexican peso/MXN/$ |

Landed cost for Mexico

The landed cost for a cross-border transaction includes all duties, taxes, and fees associated with the purchase. This includes:

- Product price

- Shipping

- Duties

- Taxes

- Fees (currency conversion, carrier, broker, customs, or government fees)

Mexican duty, tax, and de minimis

Further explanation of duty, tax, and de minimis provided below

Duty and tax de minimis

- Duty de minimis: 1,000 USD

- Tax de minimis: 50 USD

Based on the FOB value of the order

De minimis value

Duty and tax will be charged only on imports into Mexico where the total FOB value of the import exceeds Mexico’s duty or tax de minimis. If the FOB value of an order to Mexico is over 50 USD, then tax will be charged. If the FOB value of an order to Mexico is over 1,000 USD, then duty will be charged. Shipments with an FOB value under the tax and duty de minimis will be considered a tax-free and duty-free import; if the FOB value is over both of the de minimis values, duty and tax will be charged.

Import tax

- Mexico has a tiered tax-based structure ranging from 16% to 20%

Applied to the CIF value of the order

Impuesto al valor agregado (IVA)/Value-added tax (VAT)

The value-added tax (VAT)/Impuesto al valor agregado (IVA) in Mexico varies from 16%-20% for U.S. and Canadian imports. For the rest of the world, the IVA rate is 19%-20%.

Import duty

- Average duty rate: 5.8%

Applied to the CIF value of the order

Duty rate

Mexico’s duties are calculated based on the CIF value of the order, except for goods originating from the U.S. and Canada for which the FOB value is used. Mexico’s average duty rate is 5.8%.

Other taxes and fees

Excise

- Alcohol: The tax rate depends on the amount of alcohol, but the most common tax rates are 26.5%, 60%, and 53%.

- Tobacco: The tax rate depends on the type of tobacco product. Homemade tobacco products receive a 30.4% tax, while the others commonly receive a 160% tax.

- Pesticides: The excise tax rates for pesticides are 6%, 7%, and 9%.

- Gambling and lotteries: The excise tax rate for gambling and lotteries is 30%.

- Junk food: Foods above 275 kilocalories per 100 grams receive an excise tax of 8%.

Countervailing and antidumping

-

Countervailing duty (CVD) and antidumping (AD) fees are extra duty charges to offset what the country (in this case, Mexico) believes to be dumping or subsidizing certain products that compete with their domestic industry by unfairly traded imports.

-

The International Trade Administration’s (ITA) Enforcement and Compliance calculates the antidumping (AD)/ countervailing duty (CVD) rates and what imports the duties apply to. The Customs and Border Protection (CBP) carries out these decisions and collects the AD/CVD imposed on the imports. The importer is responsible for the AD/CVD charges. These resources outline how to determine if your imports are subject to AD/CVD rates:

Simplified tax regime

- Mexico operates a "simplified" tax regime where shipments with a customs value under 1,000 USD are assessed in a way in which duty and taxes are listed as one line item on an invoice. For orders under 1,000 USD, the import duty is calculated and listed in the tax line of the invoice, but for orders over 1,000 USD, the duty is listed separately.

Landed cost examples

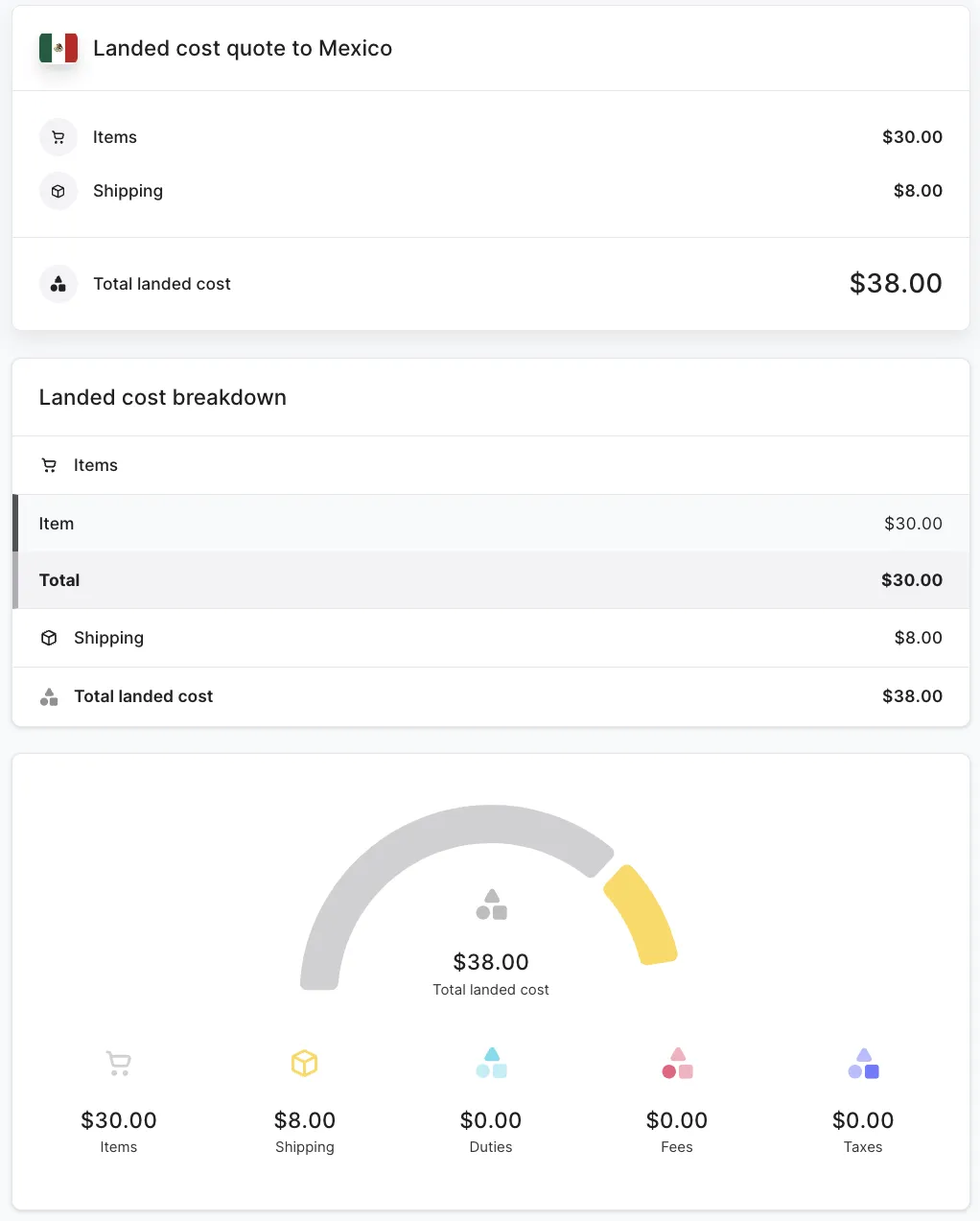

Below are sample landed cost breakdowns for Mexico (one below the duty and tax de minimis and one above the tax de minimis) calculated using Zonos Quoter:

Landed cost for a shipment to Mexico below the de minimis value:

Landed cost for a shipment to Mexico above the de minimis value:

Trade agreements

Mexico has at least 13 trade agreements with 50 countries that offer a zero or highly discounted duty rate for goods made in participating countries.

Currently, Mexico has the following arrangements:

- 32 agreements for the promotion and reciprocal protection of investments with 33 countries

- 9 limited-scope agreements within the framework of the Latin American Integration Association (ALADI)

- Membership in the Trans-Pacific Partnership Treaty

- The most prominent of these trade agreements is the T-MEC/USMCA

Tratado entre México, Estados Unidos y Canadá (T-MEC)

T-MEC provides special duty rate treatment on shipments between the U.S., Mexico, and Canada.

On July 1, 2020, T-MEC replaced NAFTA (North American Free Trade Agreement), which was one of the oldest and most well-known trade agreements. T-MEC allows for minimal formal entry procedures and saves consumers money, encouraging global trade as a result. T-MEC offers substantial savings for merchants importing goods made in the U.S., Canada, or Mexico, that meet the rules of origin requirements.

Each country that is part of T-MEC calls the agreement by their own name:

- In the United States: United States-Mexico-Canada Agreement (USMCA)

- In Mexico: Tratado entre México, Estados Unidos y Canadá (T-MEC)

- In Canada: Canada-United States-Mexico Agreement (CUSMA)

It is important to add a statement to the commercial invoice certifying that the imported goods originated from a T-MEC/CUSMA/USMCA country.

Sample statement:

"I hereby certify that the goods covered by this shipment qualify as an originating good for the purpose of preferential tariff treatment under T-MEC/CUSMA/USMCA."

The tax and duty rates that Mexico provides for the U.S. and Canada under this agreement are as follows:

- Import shipments valued under or equal to 50 USD: are exempt from duties and taxes. Shipments to Mexico valued under 50 USD are classified as low-value goods. Low-value goods do not incur duty nor tax charges, provided they are cleared from customs.

- Import shipments valued from 50.01 USD to 117 USD: have an overall tax rate of 17% if the shipment comes from Canada or the U.S. Imports from the rest of the world are subject to a flat rate of 19%.

- Import shipments valued from 117 USD to 1,000 USD: have an overall tax rate of 19% regardless of the originating country, including the U.S. and Canada.

- Import shipments valued at more than 1,000 USD: have an overall tax rate of 20% for global shipments, including the U.S. and Canada. Formal clearance procedures, usually requiring additional paperwork and licenses, must be submitted for shipments over 1,000 USD. Note that these shipments will likely encounter transit delays.

- T-MEC shipments should include a certificate of origin. Any format is acceptable provided it contains the nine data elements, which include:

- Information about the certifier, exporter, producer, and importer of the good

- A description and Harmonized Tariff System (HTS) classification of the good to the 6-digit level

- The origin criteria under which the good qualifies

- The blanket period (if the certification covers multiple shipments)

- An authorized signature and date

- T-MEC shipments should include a certificate of origin. Any format is acceptable provided it contains the nine data elements, which include:

Mexico is a member of the World Trade Organization

Being a member of the World Trade Organization (WTO), Mexico must abide by the most-favored-nation (MFN) clause, which requires a country to provide any concessions, privileges, or immunities granted to one nation in a trade agreement to all other WTO member countries. For example, if a country reduces duties by 10% for one country, the MFN clause states that all WTO members will have their duties cut by 10% in that country.

Customs resources

Mexico’s Customs authority

Official Portal of Mexico- Servicio de Administración Tributaria (SAT)

Customs refunds in Mexico

Mexico uses an online SAT portal, or tax services module, to process VAT refunds, which requires registration and file forms of taxpayer identification, (referred to as Registro Federal de Contribuyentes or RFC).

Note: Talk to your carrier about customs refunds.

Shipping and compliance

Top courier services:

- DHL Express

- FedEx

- UPS

- USPS

- Correos De Mexico

- Estafeta

- RedPack

Depending on the courier, additional shipping fees may include:

- Tracking

- Insurance

- Fuel surcharge

- Remote delivery charge

- Signature fee

- Overweight or oversized fee

- Special handling fee

- Dangerous goods fee

- etc.

Documentation and paperwork

To clear customs in Mexico, specific documentation is required for every shipment. Failure to include required details—especially the tax ID—can result in customs holds or returns.

-

- Must include the recipient’s RFC (Registro Federal de Contribuyentes)—this is the recipient’s tax identification number and is mandatory for all imports into Mexico. This must appear in the recipient tax ID field on the invoice.

- Accepted values: RFC, CURP (Clave Única de Registro de Población), or a foreign tax identification number.

-

Certificate of origin: If the value of goods (cart value prior to transportation) is over 1,000 USD

Get more details at the International Trade Administration’s Import Requirements and Documentation page.

Restricted, prohibited, and controlled imports into Mexico

Government agencies regulate imports.

Prohibited items

- Of poppy

- Marijuana

- Thallium sulfate

- Diacetylmorphine

- Electrical, electronic, and household appliances

- Beer

- Cigars

- Plywood

- And more

Restricted items

- Used tires and merchandise

- Used clothes

- Weapons, cartridges, explosives

- Extracts, essences, concentrates, or any coffee base

- And more

Legal regulations for businesses

Registration

(For B2B shipments) The business importing goods into Mexico (the recipients) needs to register in Mexico as a business and obtain a tax ID number. This is accomplished with the Mexican government's Official Register of Importers, known as the “Padron de Importadores.” This registration will allow the importer to be part of the Mexican Tax Authority (SAT).

Customs broker

Many shipments require a broker to clear the shipment. All shipments are subject to pre-inspection by the customs house broker. It is advised that high-value shipments (valued at over 1,000 USD) use a local customs broker.

What are the most popular ecommerce platforms in Mexico?

The top five most popular ecommerce platforms in Mexico are Amazon.com.mx, Walmart.com.mx, Shein.com.mx, liverpool.com.mx, and Coppel.com.mx.

Mexico country guide

Learn about cross-border ecommerce, shipping, and importing.

If you are looking to grow your ecommerce business into Mexico , you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Mexico.

, you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Mexico.